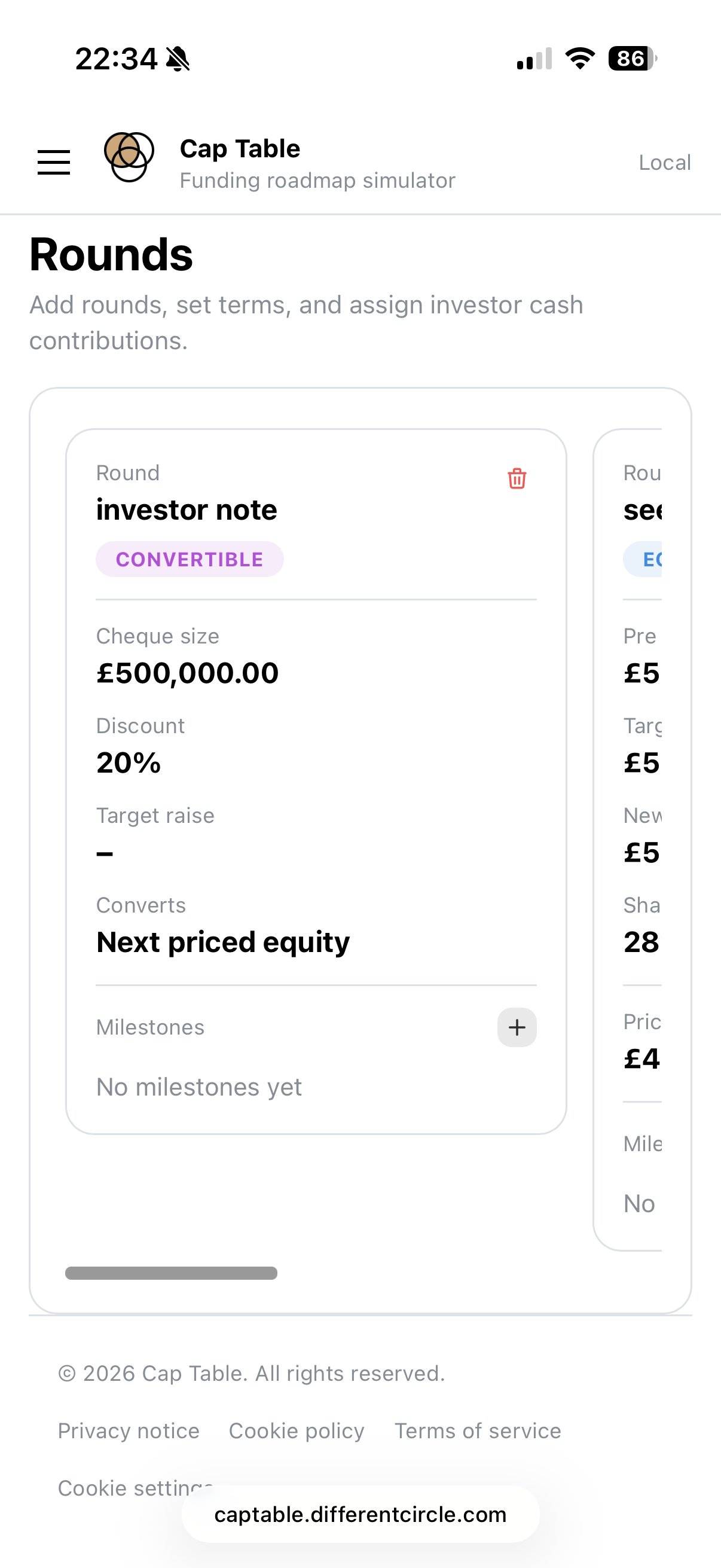

From notebook sketches to a tool founders can actually use

A fast, founder first share cap simulator designed for early SEIS and EIS rounds. Built from real conversations with founders, it lets you sketch fundraising scenarios quickly, capture milestones and use of funds, and see the impact of structure changes clearly. Deterministic calculations and rule based flags help surface founder unfriendly terms and dilution pressure early, while decisions are still easy to change.

My Favourite Graph: When to Hire for Sales Growth

Over the last few months, I have had the same conversation with many early stage founders and emerging entrepreneurs, and it comes down to when and how to hire for sales growth. In my previous journey, and after a few false starts, I managed to reach the fabled £1M+ annual revenues. I have tried to understand it from a founders perspective, but potential reasoning came to me when I came across what I have spoken about as “my favourite graph”.

What does it mean when an investor says “too Early”?

In the spin-out world, “too early” is one of the most common phrases investors use and one of the most misunderstood.

When a founder hears it, it can sound like a polite rejection. In reality, it is usually a signal about risk. Investors are not saying “come back in a year.” They are saying, “we cannot yet see the path from technology to revenue.”

what does success look like?

For academic founders, success often starts as a research ambition, an idea that might change the world if it can just make it out of the lab. Then the spin-out begins, and success becomes a checklist: secure the licence, raise the seed round, build the prototype, hire the team. Before long, the original curiosity that drove the research is replaced by investor updates, board meetings, and burn rates.

At that point, it is easy to look outward for validation. We read headlines about Unicorns, billion dollar start-ups, and wonder where…

You Don’t Need to Know a P&L to Start a Company (But You Should Learn Fast)

You don’t need to know a P&L to start a company, but you should learn fast. Find someone who’s been through it before and watch how they think about money, not just how they count it. If you’re grant funded, treat every project review like a board meeting and present your finances as if they were company accounts. Act like a CTO or CEO to become one.